|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

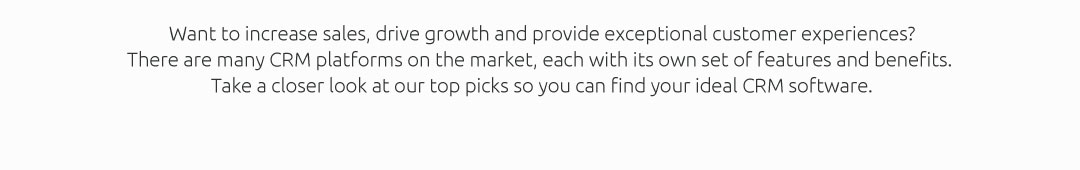

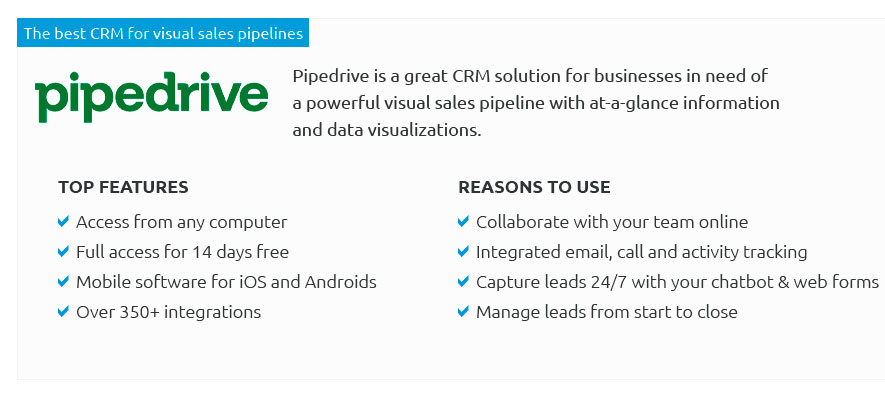

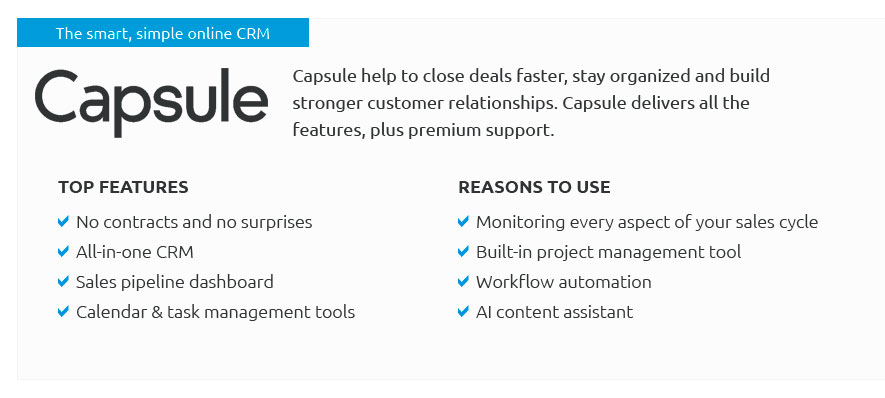

Understanding Financial CRM Systems: A Comprehensive GuideIn today's fast-paced financial landscape, businesses are increasingly turning to Financial Customer Relationship Management (CRM) systems to enhance their customer interactions and streamline their operations. These sophisticated platforms are designed to integrate seamlessly into a company's existing processes, offering a range of benefits that can significantly impact both customer satisfaction and bottom-line performance. But what exactly are financial CRM systems, and how can they be leveraged for maximum advantage? In this article, we delve into the intricacies of these systems, exploring their features, benefits, and best practices for implementation. What is a Financial CRM System? At its core, a financial CRM system is a specialized tool tailored to meet the unique demands of financial services firms. Unlike traditional CRM platforms, which cater to a broad range of industries, financial CRM systems are designed with features that address the specific needs of banks, investment firms, and insurance companies. These systems provide a centralized platform for managing customer data, tracking interactions, and analyzing customer behavior, thereby enabling businesses to deliver personalized services and build stronger relationships with their clients. Key Features and Benefits The hallmark of a robust financial CRM system lies in its ability to integrate and analyze large volumes of customer data efficiently. This capability allows financial institutions to gain deep insights into customer preferences and needs, facilitating more targeted marketing efforts and enhanced service delivery. Furthermore, these systems often include tools for automating routine tasks, such as scheduling appointments, sending reminders, and generating reports, thereby freeing up valuable time for employees to focus on more strategic activities. Additionally, the analytical capabilities of CRM systems provide actionable insights that can inform decision-making and drive business growth.

Implementing Best Practices While the advantages of financial CRM systems are clear, successful implementation requires careful planning and execution. Here are a few best practices to consider: First, it is crucial to assess the specific needs of your organization and choose a CRM system that aligns with your strategic goals. Customization options should be evaluated to ensure the system can adapt to evolving business requirements. Additionally, investing in training and support for your team can significantly enhance user adoption and maximize the return on investment. Finally, continuous monitoring and evaluation of the CRM system's performance will ensure it remains effective and aligned with organizational objectives. In conclusion, financial CRM systems have emerged as indispensable tools for financial services firms looking to enhance customer engagement and streamline their operations. By understanding their features and benefits, and by implementing best practices, organizations can unlock the full potential of these systems, driving sustained growth and competitive advantage in the dynamic financial services landscape. https://www.salesforce.com/financial-services/cloud/crm/

Financial CRM (customer relationship management) is a type of software that helps businesses improve their interactions with customers. https://www.hubspot.com/products/crm/finance

CRM (customer relationship management) software helps businesses track interactions with their clients. While these software solutions have been around for ... https://www.zoho.com/crm/solutions/financial-services/

Financial services CRM system to help you gain complete understanding of your clients' needs. Ideal for banking, wealth management, investment, mutual funds ...

|